ÇANAKKALE SERAMİK YER KAROLAR - YapıMalzemeleriBurada: Banyo Tadilat ,mutfak dolapları,küvet,duş kabin,tekne,batarya

0532 491 11 80 | Şişli Fayans, Seramik, Kalebodur Döşeme (Ustası, Ustaları, Firması, Firmaları, Fiyatları)

SERAMİK FAYANS KAPLAMA ÜRÜNLERİ,YER SERAMİK, PORSELEN KAROLAR,MOZAİK VE ÇİNİ DEKORLULAR,PARKE, AHŞAP DEKORLULAR,DERİ DEKORLULAR,DOĞALTAŞ VE MERMER DEKORLULAR,KAYMAZ KAROLAR,DIŞ MEKAN VE HAVUZ, BAHÇE KAROLARI,COTTO KAROLAR,DUVAR SERAMİK VE FAYANS K

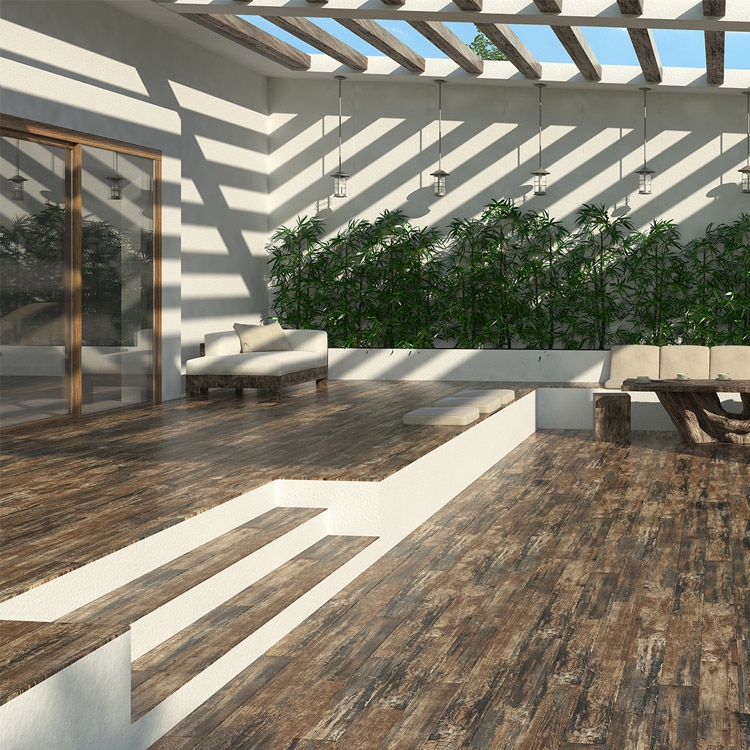

Balkonunuza Farklı Bir Hava Katacak Seramik Modelleri - 20 Balkon Seramik Modeli | STİL DANIŞMANI | Yurtbay Seramik

Parke Görünümlü Seramikler Nerelerde Kullanılabilir? Avantajları Nelerdir? | STİL DANIŞMANI | Yurtbay Seramik