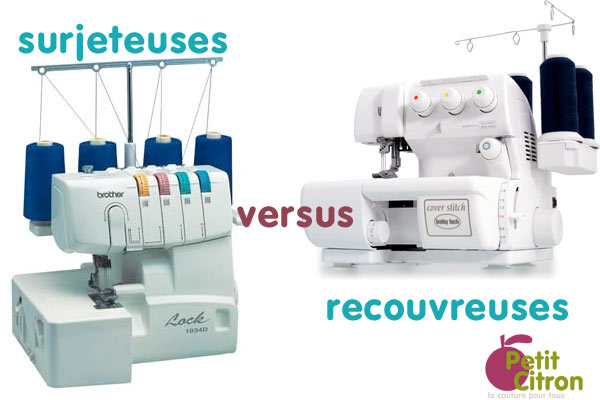

J'apprends à coudre à la surjeteuse et à la recouvreuse - 15 modèles, 50 leçons pas à pas - patrons à taille réelle - Emilie Rouffiat - Clémentine Lubin - 9782848319452 - Livres Loisirs créatifs - Loisirs - Nature - Voyage - Livre

J'apprends à coudre à la surjeteuse et à la recouvreuse 50 leçons, 15 modèles - broché - Clémentine Lubin - Achat Livre | fnac