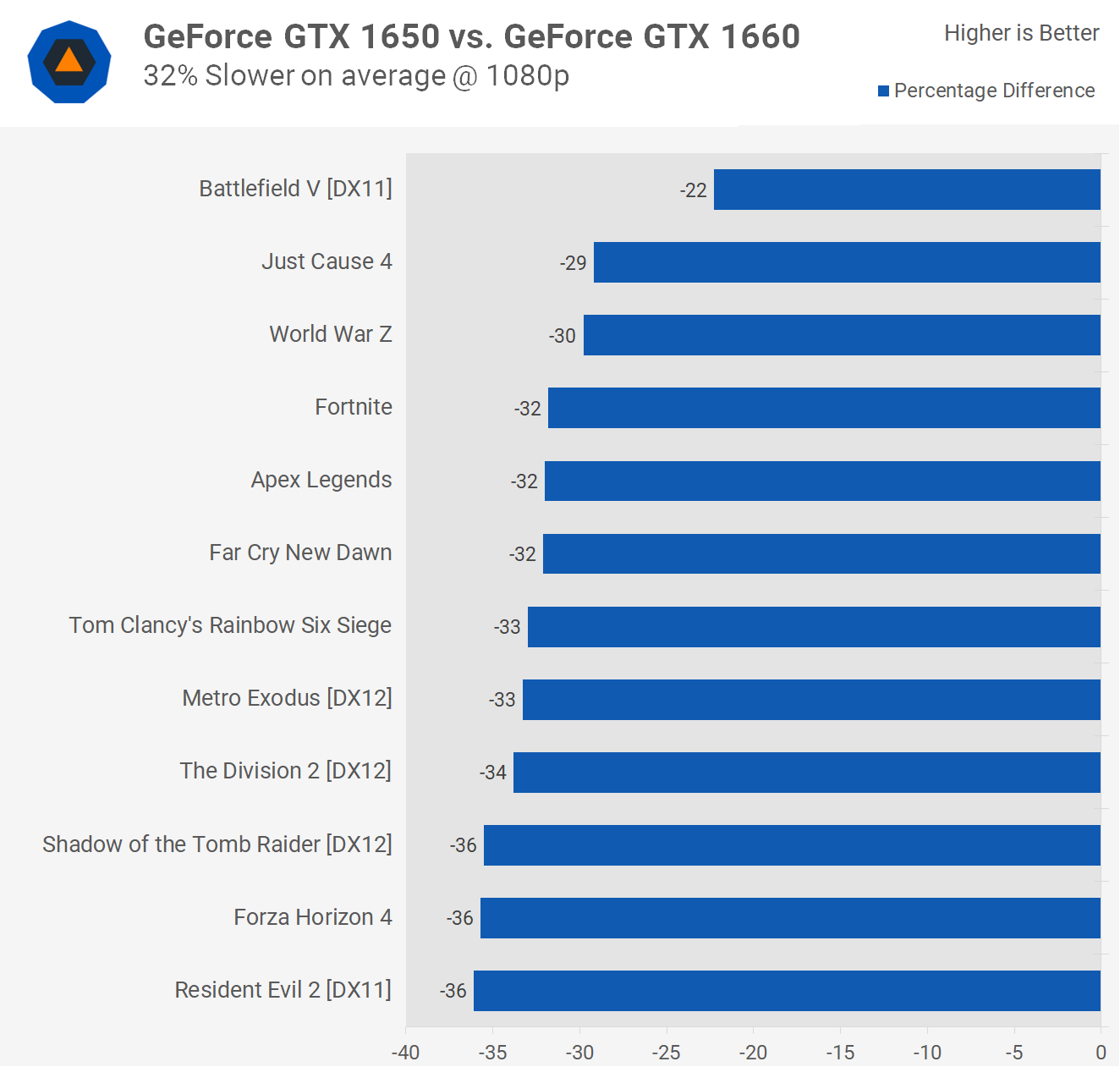

EVGA GTX 1660 Review vs. GTX 1660 Ti, RX 590, & More | GamersNexus - Gaming PC Builds & Hardware Benchmarks

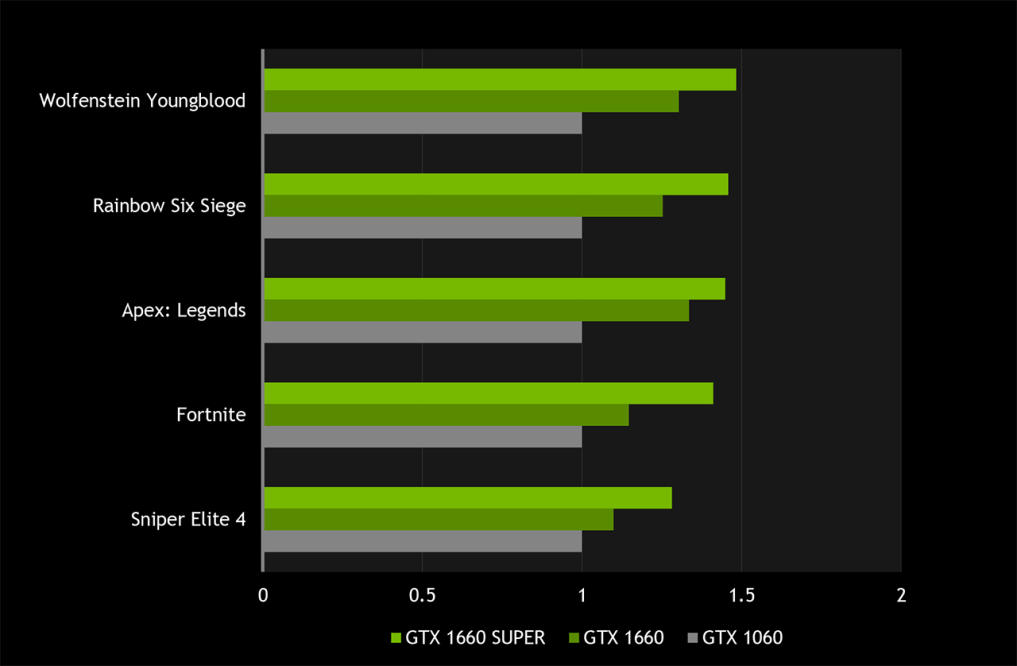

Nvidia are reportedly prepping a GTX 1660 Super, and I'm completely baffled by it | Rock Paper Shotgun

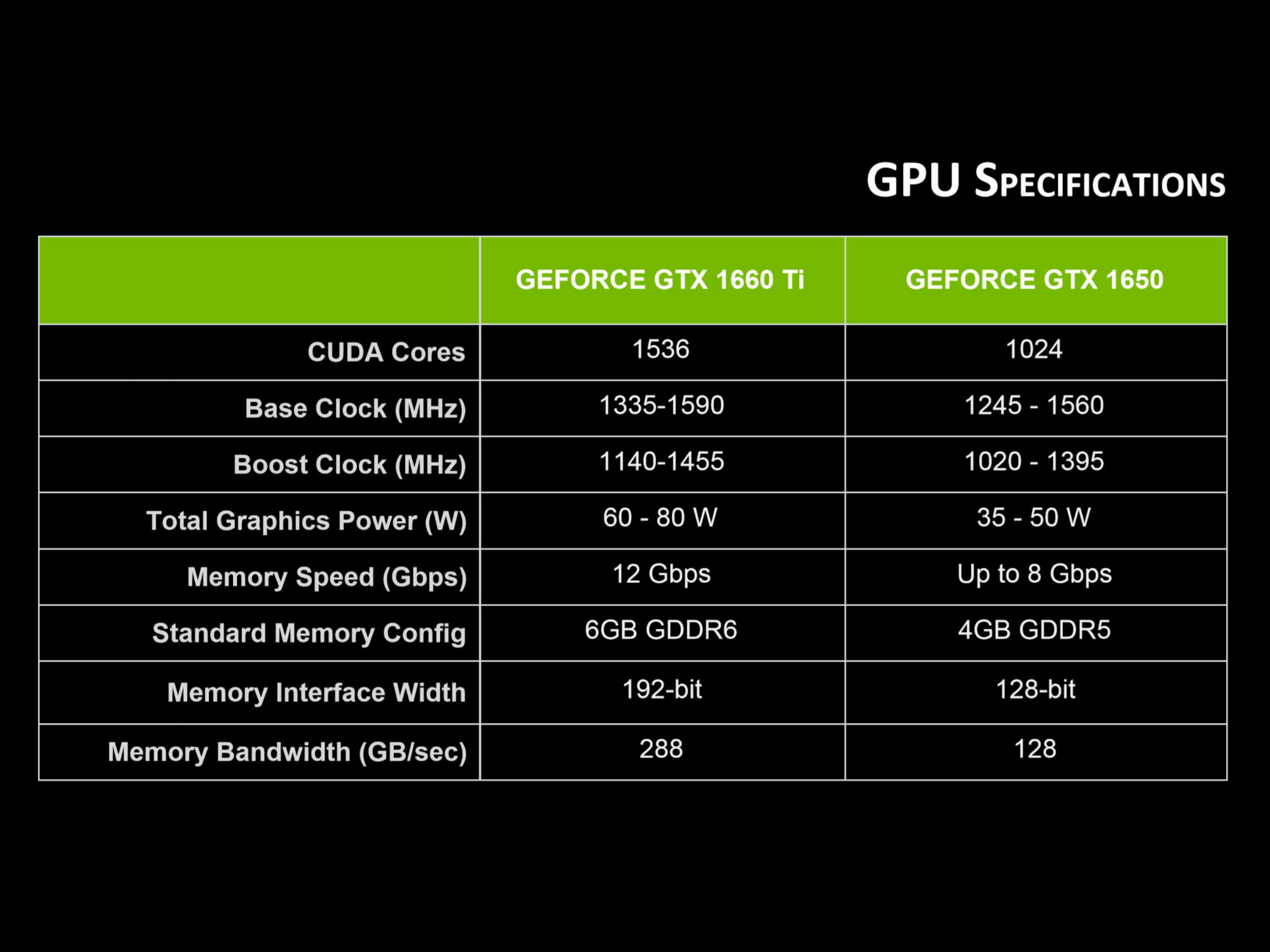

NVIDIA GeForce GTX 1660 Ti vs GTX 1650 - TU116 is faster but do you need all that power | LaptopMedia.com

![Nvidia GTX 1650 vs 1660 Ti: Laptop GPU Comparison [2023] Nvidia GTX 1650 vs 1660 Ti: Laptop GPU Comparison [2023]](https://www.theworldsbestandworst.com/wp-content/uploads/2022/06/3-1.png)