Nett Original Tampon sans Applicateur, Super Plus, Boite de 24 Tampons : Amazon.fr: Hygiène et Santé

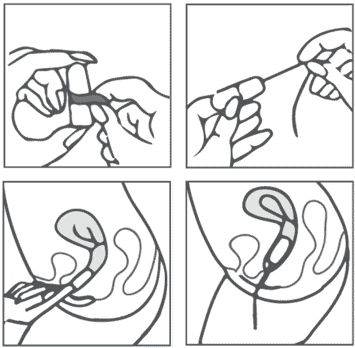

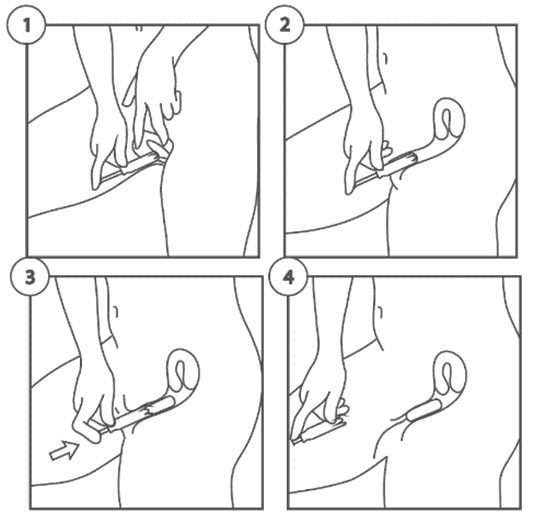

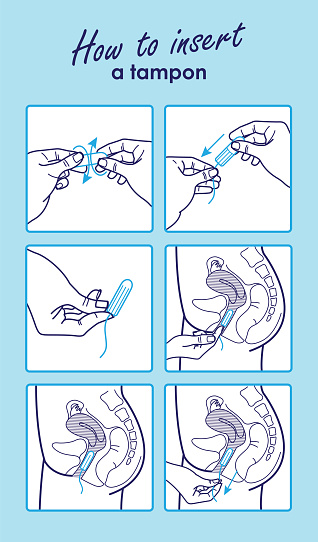

Instructions De Vecteur Comment Insérer Un Tampon Comment Utiliser Un Tampon Sans Applicateur Vecteurs libres de droits et plus d'images vectorielles de Tampon hygiénique - iStock