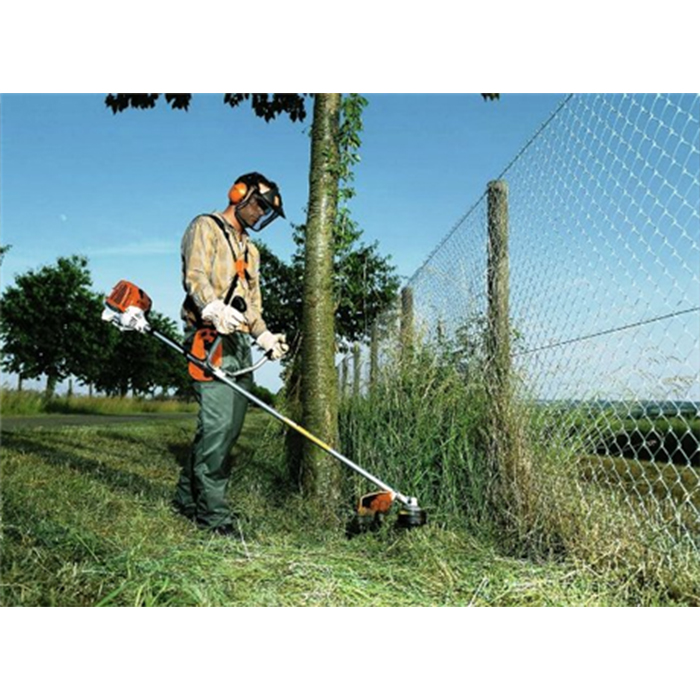

STIHL FS 120, Motorna kosa – trimer, 30.8 cm³, 1.8 ks, 6.3 kg – NID Beograd – specijalizovani prodavac STIHL

Prox BiH - ⚠ AKCIJA MOTORNIH KOSA - TRIMERA STIHL© ⚠ ➡Motorna kosa / trimer STIHL FS 120 - 831 KM Profesionalni trimer !!! Za rad na većim površinama i u žilavoj