L'actrice Evan Rachel Wood accuse Marilyn Manson de viol dans un documentaire | Arts | Le Quotidien - Chicoutimi

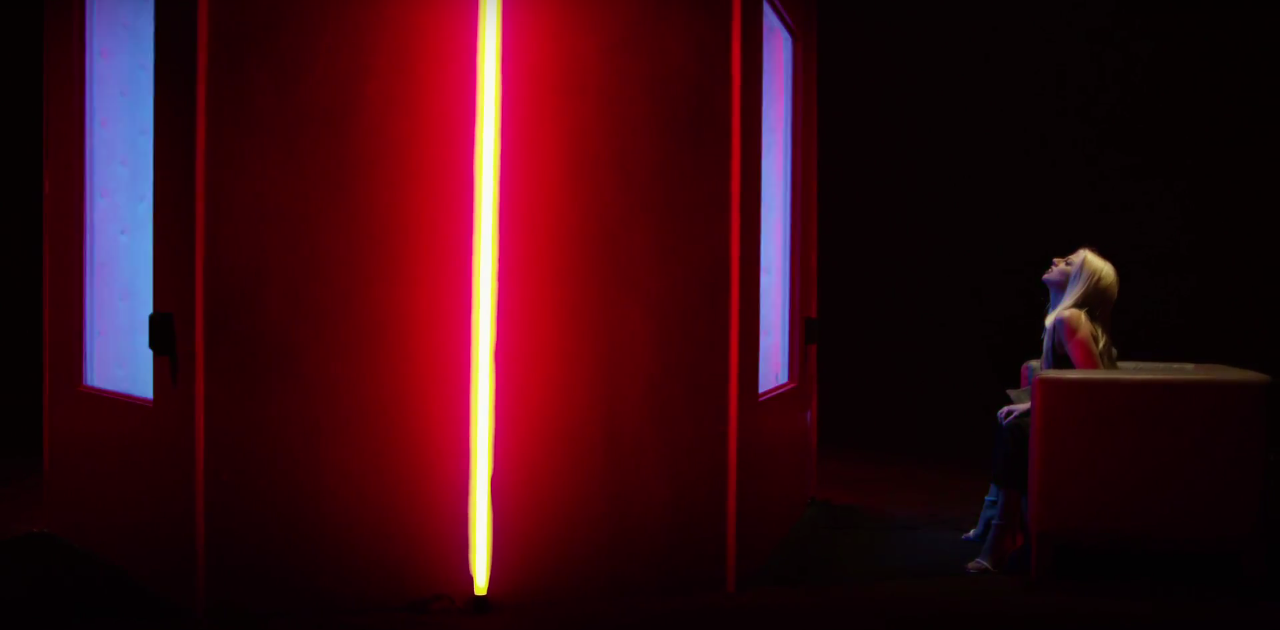

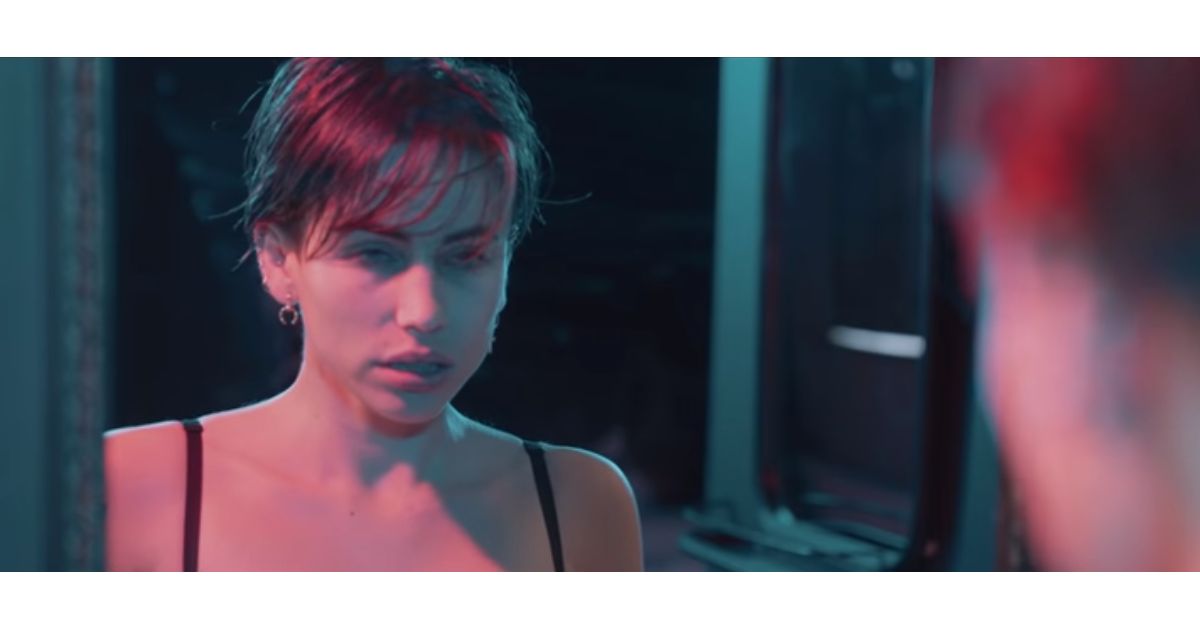

Natasha" : Gaëlle Garcia Diaz invite Cara Saint-Germain et Joeystarr pour un clip sombre - Purebreak

Qui est la Lucky Girl ? Cette actrice philippine a reçu un message de l'acteur"All of Us Are Dead"Yoon Chan Young - K-Pop News Insde FR