Avene Cold Cream Pain Surgras for Dry Skin, 100g: Buy Online at Best Price in Egypt - Souq is now Amazon.eg

Avène Trixéra Nutrition Pain Surgras Au Cold Cream Soap 100 G: Buy Online at Best Price in UAE - Amazon.ae

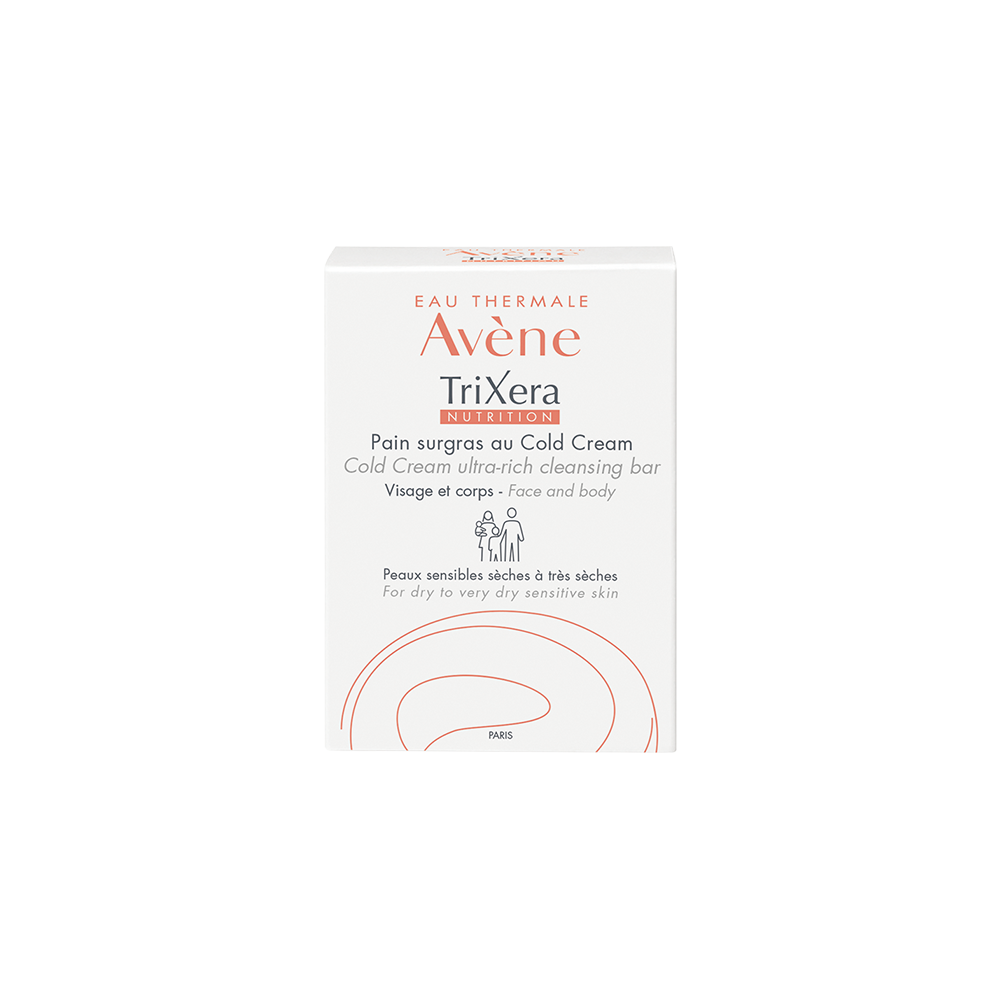

Eau Thermale Avène TriXera Nutrition Cold Cream Ultra-rich Cleansing Bar - Cleansers | EAU THERMALE AVENE - nicolas care store

Emollient Cold Cream Cleansing Bar - Avène - Cold Cream - Cosmetic products index - CosmeticOBS - L'Observatoire des Cosmétiques

Avene Cold Cream Pain Surgras For Dry Skin 100 g, Pack of 1 : Buy Online at Best Price in KSA - Souq is now Amazon.sa: Beauty