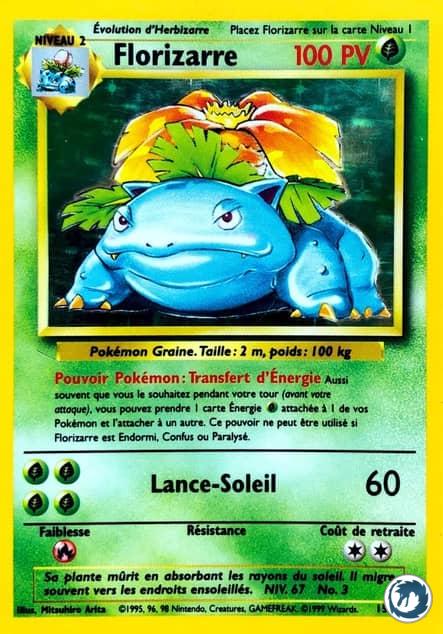

Carte pokemon - florizarre 3/73 - holo-reverse - édition soleil et lune légendes brillantes | Rakuten

Florizarre et Vipélierre GX - Ultra Rare 1/236 - Soleil et Lune 12 Éclipse Cosmique à Fantasy Sphere,Magasin de carte à collectionner et Jeux de société à Toulouse || Fantasy Sphere