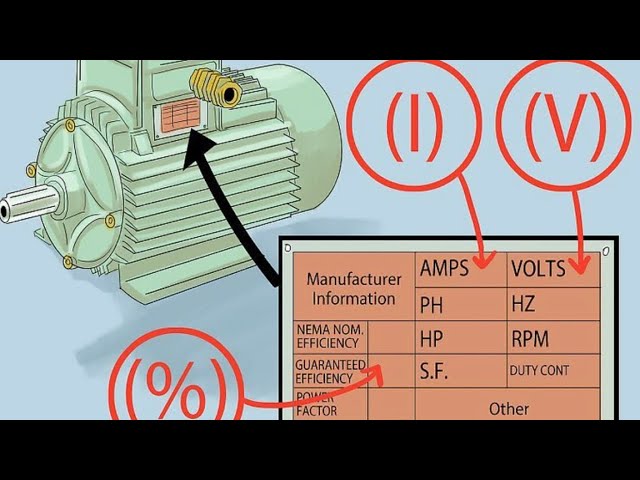

اشتري اونلاين بأفضل الاسعار بالسعودية - سوق الان امازون السعودية: موفرون محرك كهربائي بتيار متردد 1725 دورة في الدقيقة 3/4 حصان احادي الطور 56، محرك ضاغط هواء قابل للعكس بقطر 5/8 انش

IE2 4 أقطاب 1450 دورة في الدقيقة 2.2kw 3kw 3 المرحلة غير متزامن الألومنيوم الجسم SKF تأثير نوعية مضمونة موردي السيارات الكهربائية في الصين--سعر المصنع-"هينجسو القابضة"

موتور 2 حصان 3 حصان 5 حصان فلانشه وقاعده سريع وبطئ 3 فاز و2 فاز 220 فولت 380 فولت جديد واستيراد لف بلادة جسم زهر. للاستعلام : 01001811852... - مركز الاحمر موتورز للمحركات والطاقه الشمسيه وقطع الغيار والصيانة | Facebook

موفرون محرك ضاغط هواء 3 حصان 115 فولت/230 فولت FLA-18.0/9.0A 3450 دورة في الدقيقة، 5/8 انش عمود مفتاح 56 اطار 60Hz محرك كهربائي أحادي الطور لضواغط الهواء : Amazon.ae: السيارات

محرك كهربائي Gphq Yc100L2-4 بقدرة 2،2 كيلو واط بقدرة 3 حصان بقدرة 175 دورة في الدقيقة - الصين الموتور الكهربائي، الموتور، موتور التيار المتردد، موتور أحادي الطور، موتور الحث، محرك غير متزامن،

Gphq 2.2 كيلو واط/3 حصان تيار متردد أحادي الطور مزدوج/مكثف أحادي كهربي الموتور - الصين الموتور الكهربائي، الموتور، مواتير التيار المتردد، موتور التيار المتردد، الموتور الكهربائي، موتور الحث، موتور كهربائي ثلاثي الأطوار،