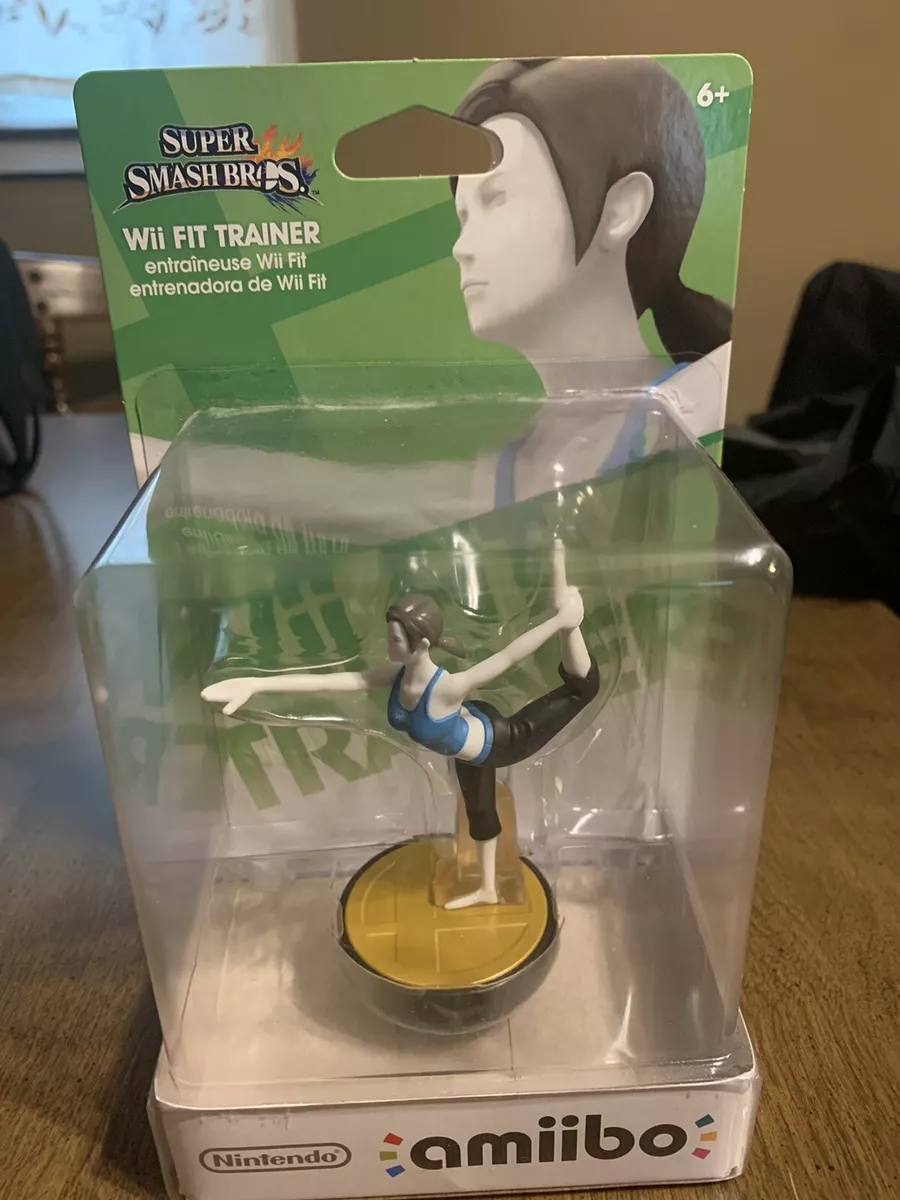

NA Original Wii Fit Trainer vs. NA Reprint Wii Fit Trainer closer look - Differences (CLOSER LOOK) Reprint purchased at TRU San Mateo, CA USA : r/ amiibo

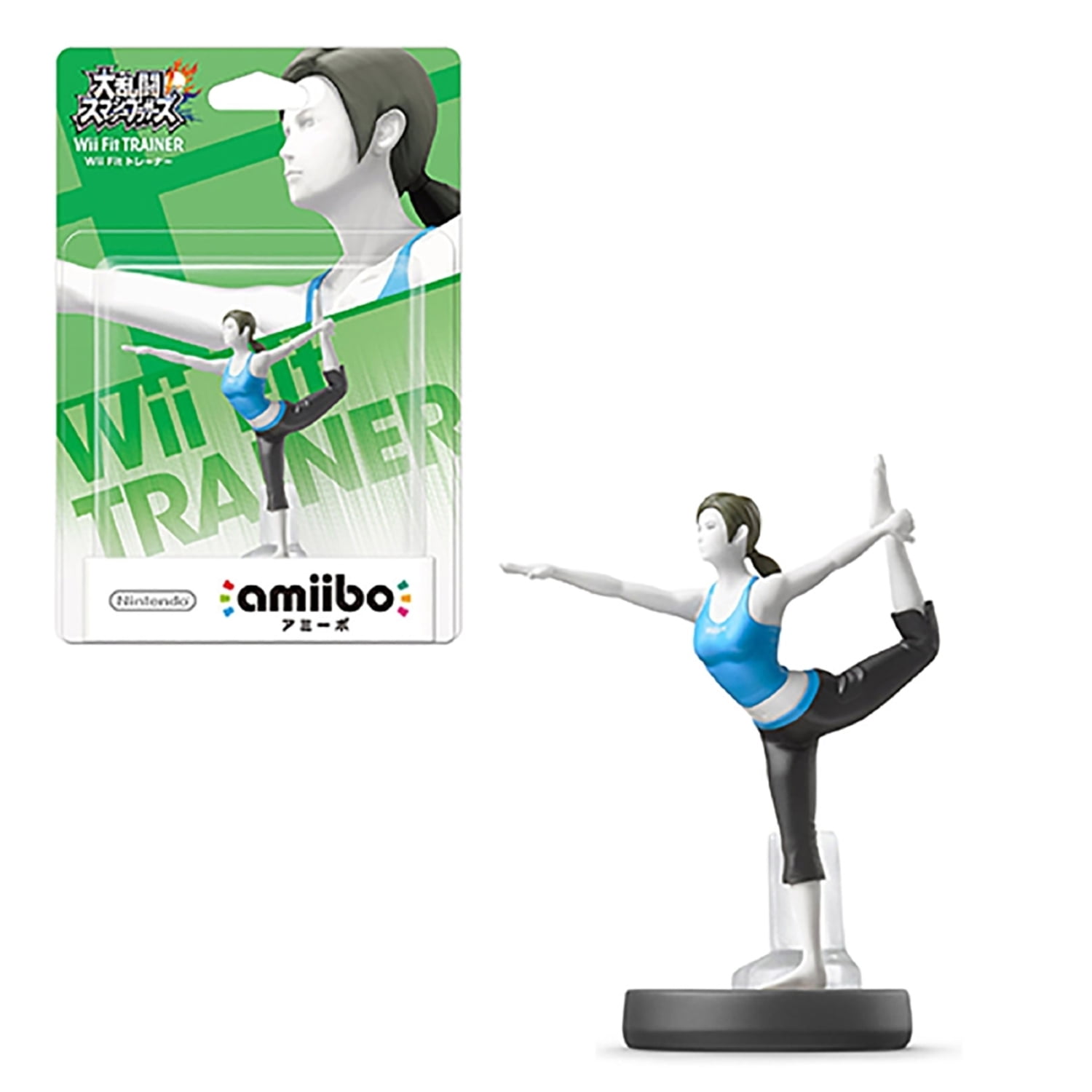

Amazon.com: Wii Fit Trainer Amiibo - Europe/Australia Import (Super Smash Bros Series) : Toys & Games