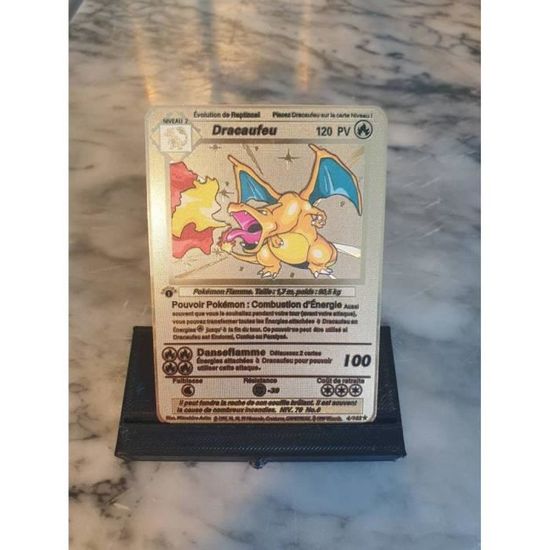

Carte Pokémon rare - Dracaufeu en Métal doré charizard - première édition Métal doré français cadeau anniversaire - Cdiscount Jeux - Jouets

🥇Cartes Pokémon dorées 1ère édition ( Dracaufeu, Blastoise et Venausaur) rare set de base - Cdiscount Jeux - Jouets

🥇Cartes Pokémon dorées 1ère édition ( Dracaufeu, Blastoise et Venausaur) rare set de base - Cdiscount Jeux - Jouets

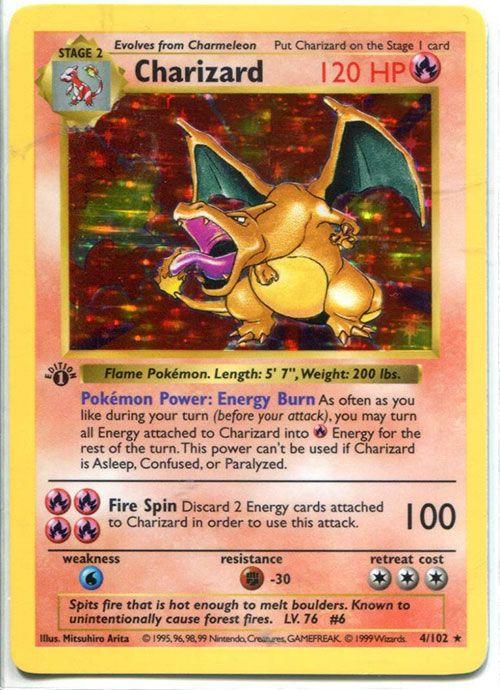

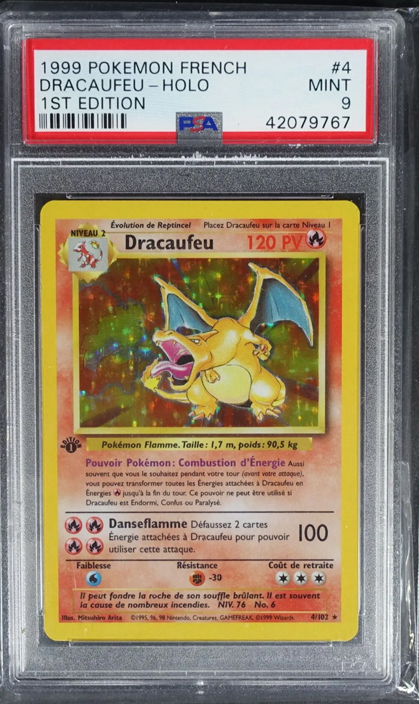

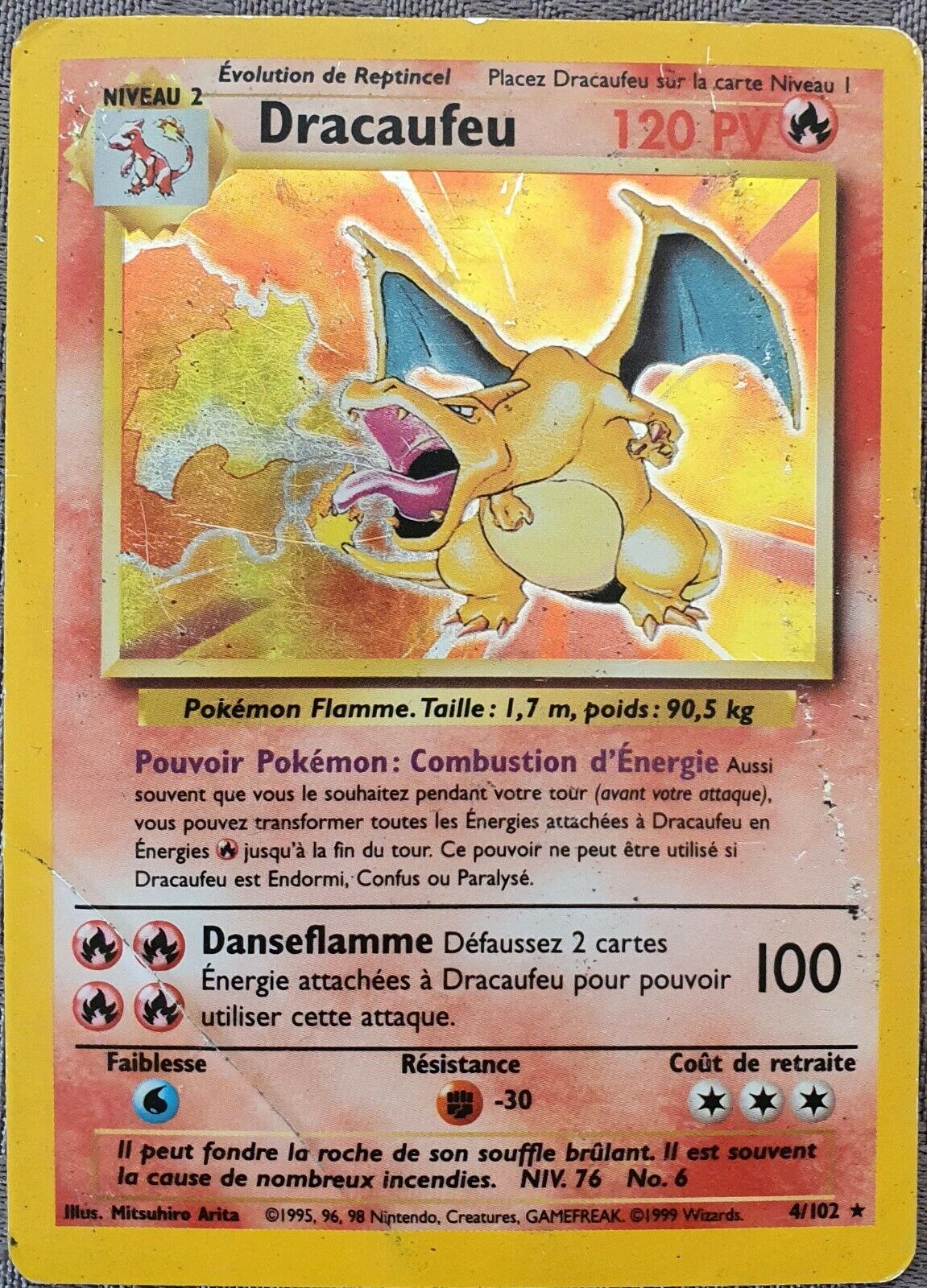

Booster Set de Base Édition 1 - Dracaufeu - Pokémon FR - Acheter vos produits Pokémon - Playin by Magic Bazar

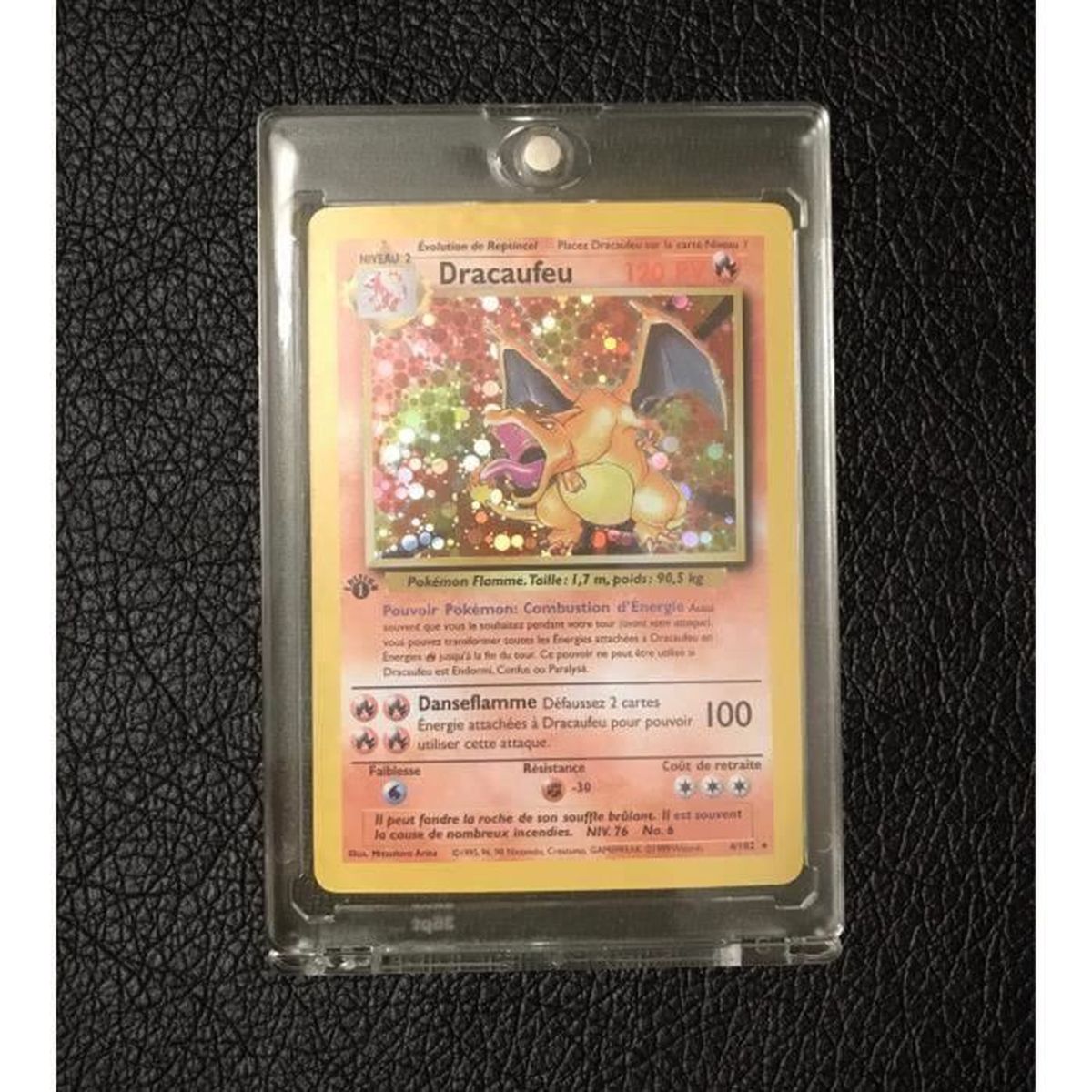

Carte Pokémon Fanmade Dracaufeu Edition 1 Holographique 4/102 Wizards Near Mint Boite cadeau - Cdiscount Jeux - Jouets

Logan Paul : pourquoi il portait une carte Pokémon à 150 000 dollars avant son combat face à Mayweather

Pokemon Card Charizard First Edition 1996 | Pokemon First French Edition Cards - Game Collection Cards - Aliexpress

CARTE POKEMON PREMIÈRE Edition Dracaufeu - Set De Base - Carte Métal Doré - FR - EUR 12,99 - PicClick FR

![Charizard [1st Edition] #4 Prices | Pokemon Base Set | Pokemon Cards Charizard [1st Edition] #4 Prices | Pokemon Base Set | Pokemon Cards](https://commondatastorage.googleapis.com/images.pricecharting.com/94bdd6451a747ee78eeae86e76e4bf67969225a9f81384ecb217a305f744a752/240.jpg)