New Balance MTNTRCS3 Trail Shoes Nitrel V3 Unboxing, Test and Fit Review UPC: 193684094189 - YouTube

New Balance MTNTRCS3 Trail Shoes Nitrel V3 Unboxing, Test and Fit Review UPC: 193684094189 - YouTube

Купить Мужские кроссовки New Balance MTNTRCS3 в интернет магазине летней и пляжной обуви Ridersandals.com.ua

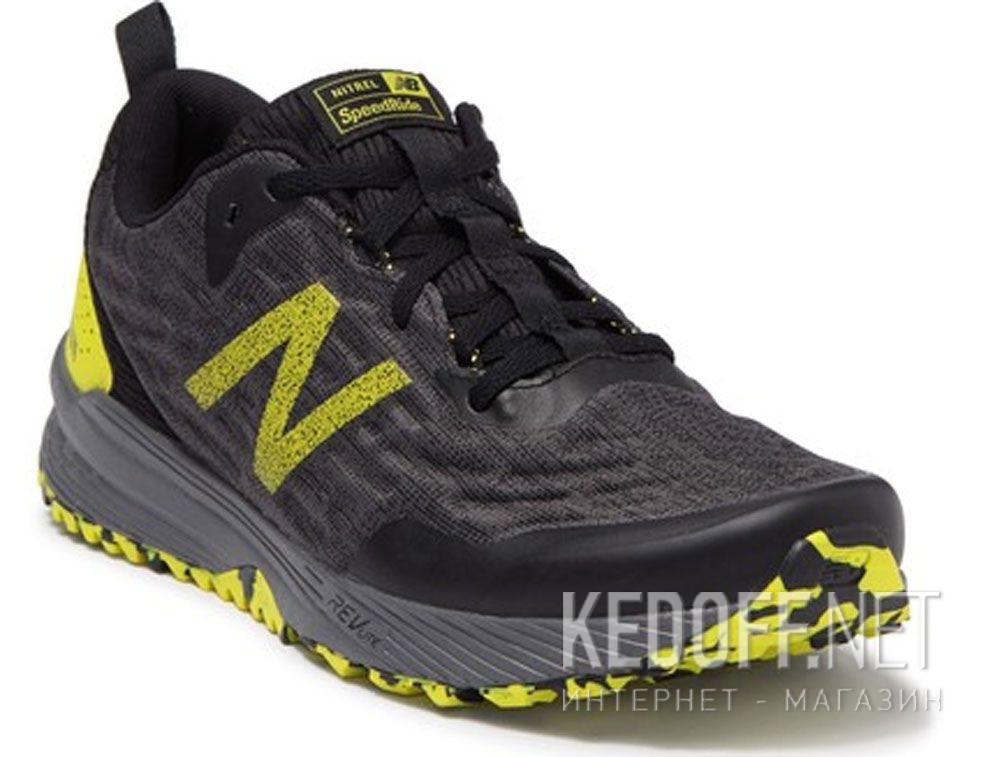

Кроссовки New Balance Nitrel MTNTRCS3 40.5 (8) 26 см Черные с желтым (193684094141) – в интернет-магазине ROZETKA | Купить в Украине: Киеве, Харькове, Днепре, Одессе, Запорожье, Львове

Кроссовки New Balance Fuelcore Nitrel V3 Grey Mtntrcs3 купить в Киеве, Харькове, Днепре, Одессе, Запорожье, Львове| Yes Original