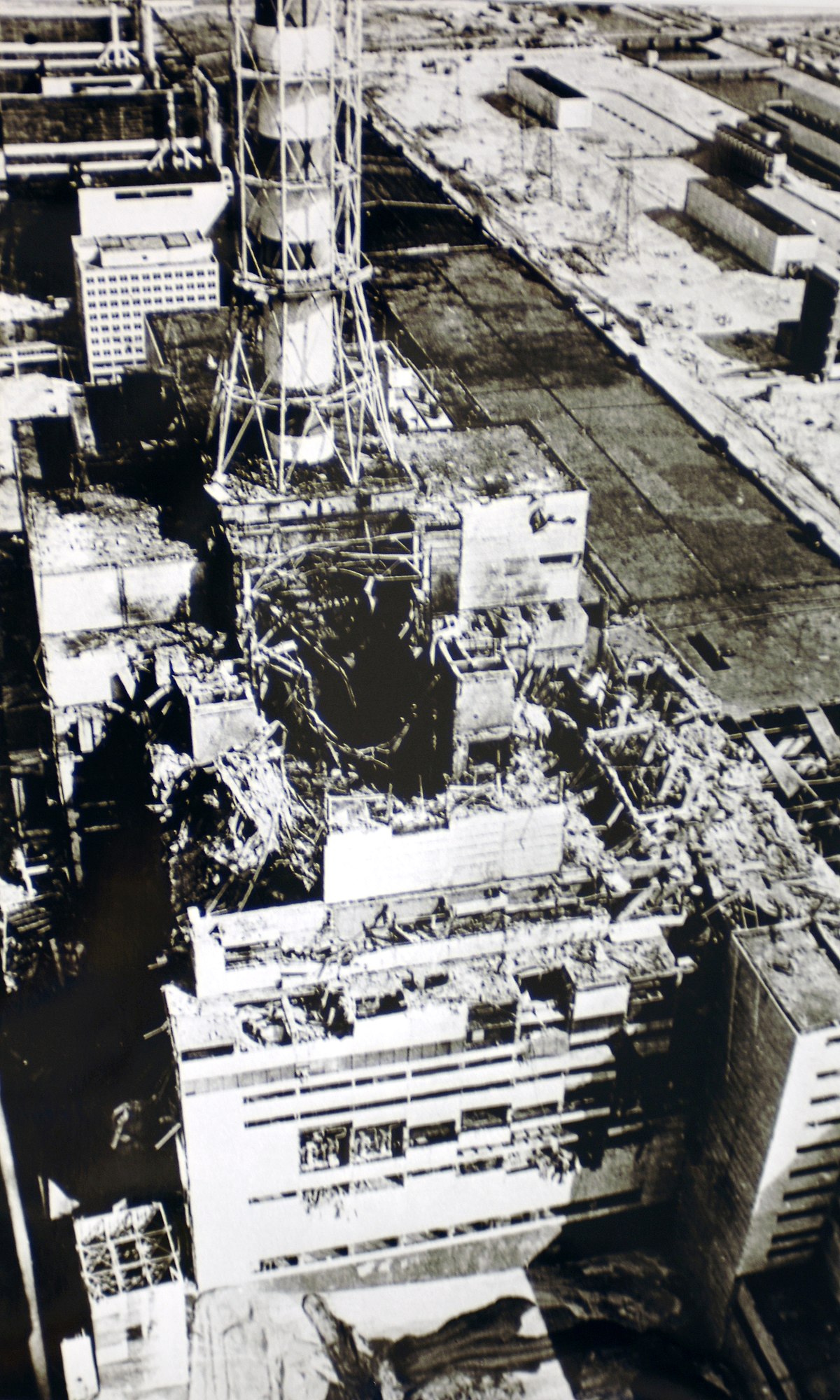

Tchernobyl, chroniques du monde après l'apocalypse : épisode • 1/5 du podcast La supplication de Svetlana Alexievitch

France Culture on X: "Tchernobyl, éléphants, ovnis et Game of Thrones: la Session de rattrapage! https://t.co/D4UUOhBlhp https://t.co/Kkwb8E85GU" / X

35 ans après Tchernobyl, les leçons du nucléaire ? Avec Bernard Bonin, Franck Guarnieri et Francis Perrin

Midnight in Chernobyl: The Untold Story of the World's Greatest Nuclear Disaster Reprint, Higginbotham, Adam - Amazon.com

Map shown during TV news in France a few days after the accident. They told us the radioactive cloud hadn't crossed the border… : r/chernobyl

Chernobyl (4K+2D Blu-ray SteelBook) [France] | Hi-Def Ninja - Pop Culture - Movie Collectible Community