Montessori maths jouet numérique singe Balance échelle éducatif maths pingouin équilibrage échelle numéro jeu de société enfants apprentissage jouets~pink monkey | Rakuten

Jeu de Singe Balance Montessori Jouet Éducatif pour Apprendre Jeu de Maths aux Enfants pour Développer l'Intelligence et Capacité - Cdiscount Jeux - Jouets

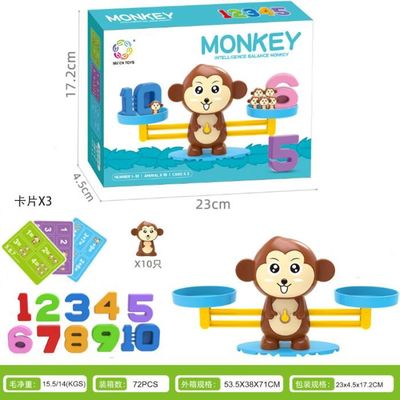

Queta Jeu de Singe Balance Montessori Jouet Éducatif pour Apprendre Les Mathématiques Jeu de Maths aux Enfants pour Développer l'Intelligence et Capacité de Coordination Œil-Main (Ensemble de 60 pcs) : Amazon.fr: Jeux

Queta Jeu de Singe Balance Montessori Jouet Éducatif pour Apprendre Les Mathématiques Jeu de Maths aux Enfants pour Développer l'Intelligence et Capacité de Coordination Œil-Main (Ensemble de 60 pcs) : Amazon.fr: Jeux

Jouet mathématique Montessori pour enfants balance de singe numérique jeu de société jouets d'apprentissage compatibles | Rakuten

Wholesale Jouet Montessori Balance singe numérique, échelle éducative maths pingouin Balance nombres jeu de société enfants jouets d'apprentissage From m.alibaba.com

Jouet de maths Montessori, Balance intelligente de singe, jeu de société numérique, matériel pédagogique éducatif | AliExpress

Queta Jeu de Singe Balance Montessori Jouet Éducatif pour Apprendre Les Mathématiques Jeu de Maths aux Enfants pour Développer l'Intelligence et Capacité de Coordination Œil-Main (Ensemble de 60 pcs) : Amazon.fr: Jeux

HOWADE Monkey Balance - Jeu de mathématiques - Balance de pesée pour singe - Montessori - Jouet éducatif pour les enfants de 3, 4, 5 ans : Amazon.fr: Jeux et Jouets

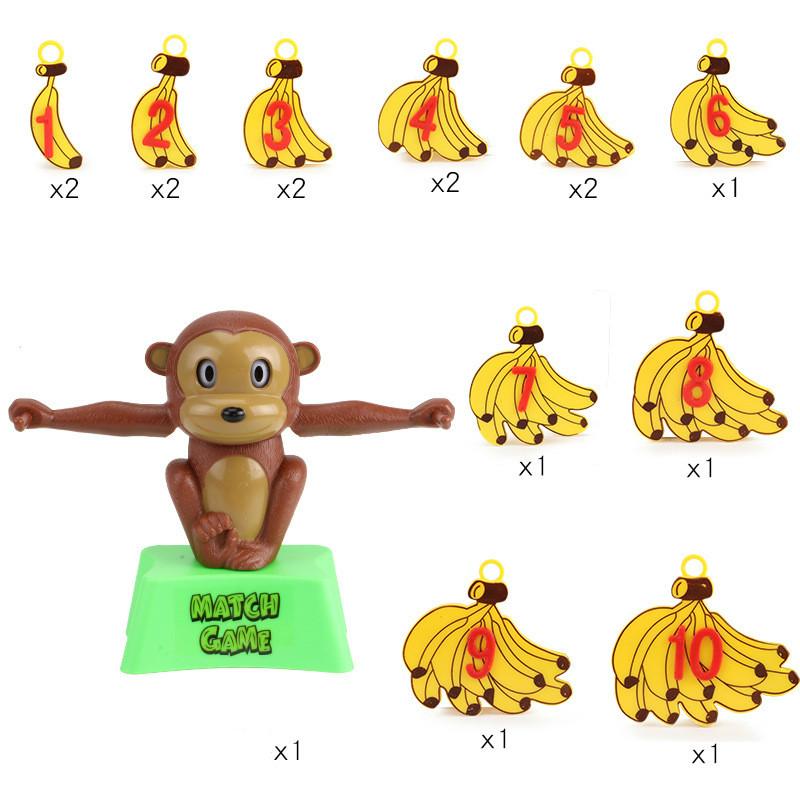

Apprentissage des Mathématiques Jeu Monkey Match, Compter Les Jouets Jeu Montessori Singe Échelle Équilibre Balance Numérique - Cdiscount Jeux - Jouets

Singe Balance Montessori Math Jouet Numérique Éducatifs Mathématiques Nombre Équilibrage Échelle Jouet Jeu de société pour Enfants Jouets D'apprentissage | AliExpress

JEU D'APPRENTISSAGE,A--Balance à singe numérique pour enfants, jeu de société éducatif, apprentissage des maths, méthode Montessori - Cdiscount Jeux - Jouets