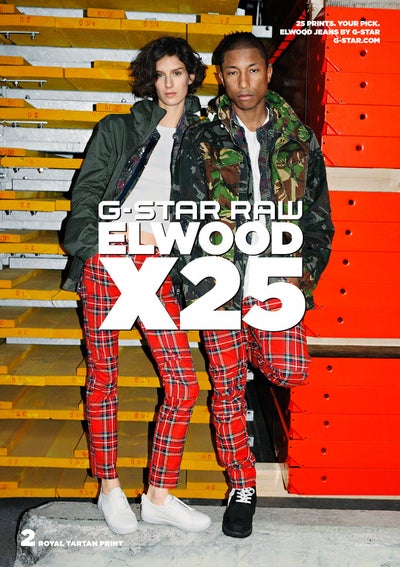

Pharrell's G-Star Raw Event ELWOOD X25 at NYFW (September 13) (2017) - The Neptunes #1 fan site, all about Pharrell Williams and Chad Hugo

G-Star Global Game Exhibition, Nov 16, 2017 : Promotional staff wearing the costumes of an online game pose on a stage at the G-Star Global Game Exhibition in Busan, about 420 km (

![Newsmaker] Online video games reclaim spotlight at Korea's biggest game convention Newsmaker] Online video games reclaim spotlight at Korea's biggest game convention](http://res.heraldm.com/content/image/2017/11/17/20171117000700_0.jpg)