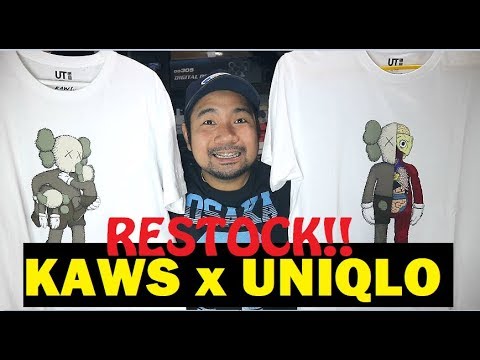

Sold-Out Uniqlo x KAWS: Summer UT Collection Will Be Restocked In Singapore On 30 August 2019 - ZULA.sg

Uniqlo x KAWS to be restocked on Aug. 30, 2019, purchase limitations apply - Mothership.SG - News from Singapore, Asia and around the world

Sold-Out Uniqlo x KAWS: Summer UT Collection Will Be Restocked In Singapore On 30 August 2019 - ZULA.sg