LOVE/ŞAMPUAN SABUN Şampuan, Essential Haircare Şampuan Sabunlar Davines Cilt Bakımı | Davines - Profesyonel Saç Bakımı ve Kozmetik Ürünleri

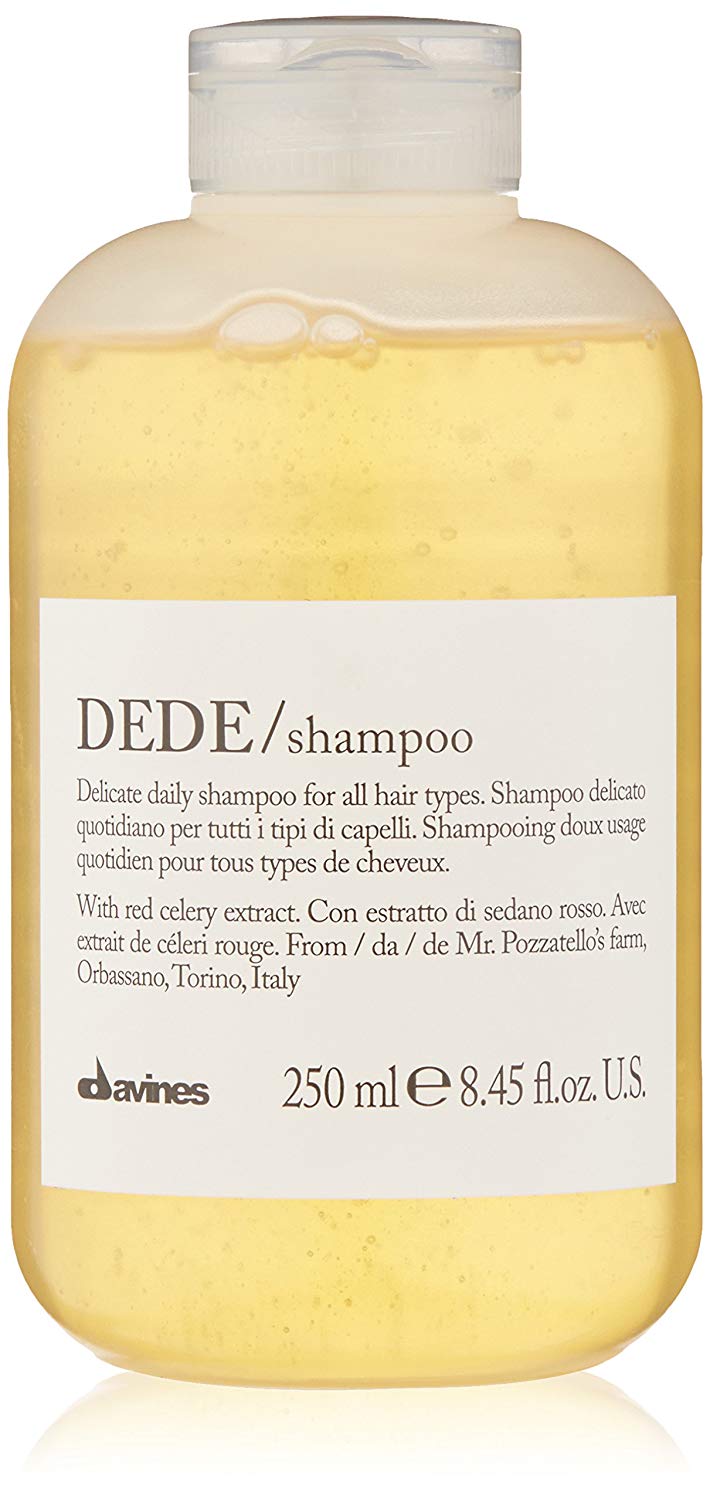

Davines Dede 250ml İnce Telli Saçları Koruma Şampuanı kullanıcı yorumları, tavsiyeleri ve fiyatları | YorumBudur.com

Amazon.com: Davines OI Shampoo | Nourishing Shampoo for All Hair Types | Shine, Volume, and Silky-Smooth Hair Everyday | 9.47 Fl Oz : Davines: Beauty & Personal Care