عاجل من الموارد البشرية: طرق الاستعلام عن الضمان الاجتماعي الجديد 2023 ومعرفة التسجيل والقبول في البرنامج التابع لوزارة الموارد البشرية - جريدة لحظات نيوز

نزلت الآن على البطاقة الرقمية... الاستعلام عن اهلية الضمان برقم الهوية+شروط التسجيل بالضمان الجديدة بعد الزيادة الملكية - صحيفة المجاردة اليوم

Link".. رابط الاستعلام عن أهلية الضمان الاجتماعي المطور 1445.. وكم معاش الضمان المطور لشهر نوفمبر 1445 بعد الزيادة الملكية؟ - بوابة مولانا

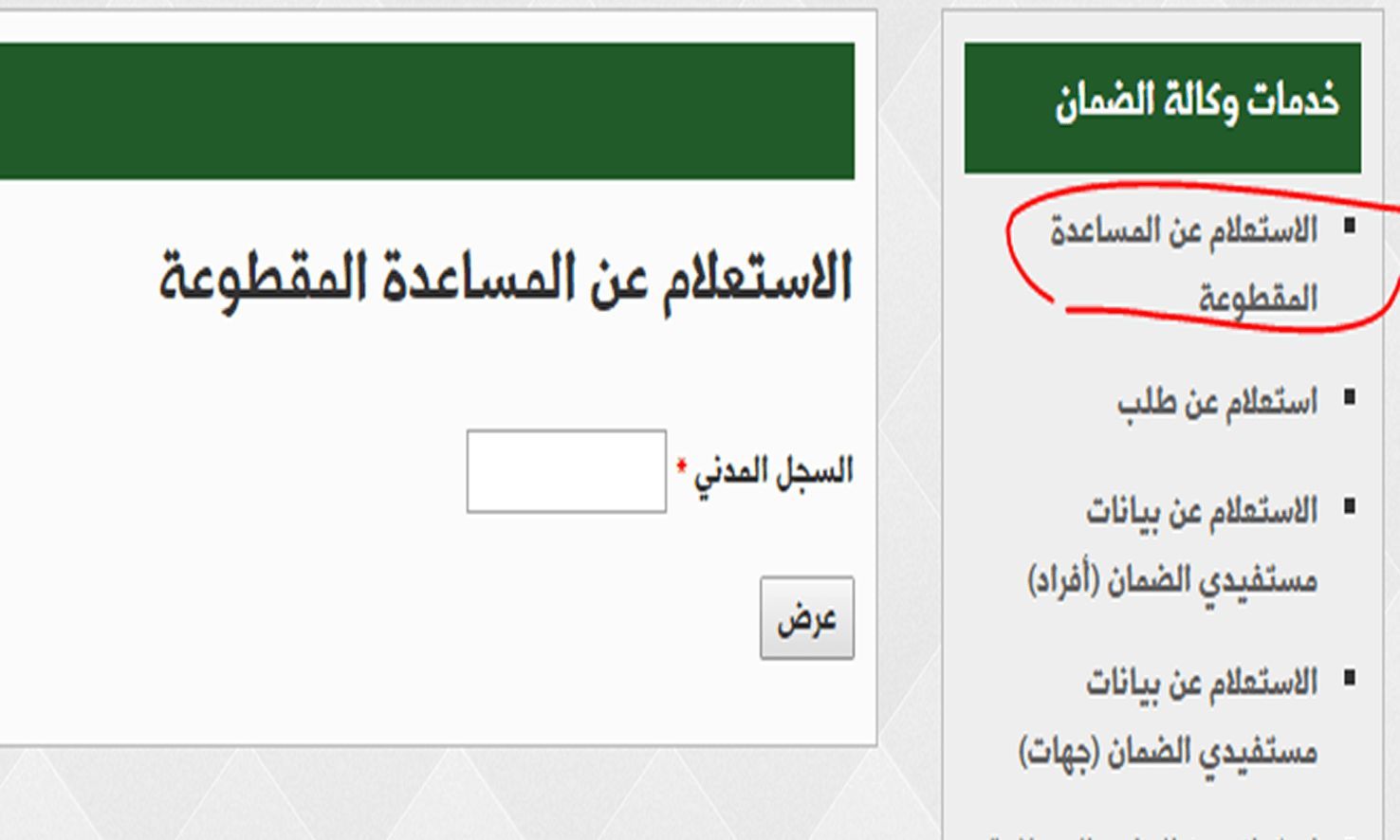

الاستعلام عن الضمان الاجتماعي المطور برقم الهوية 1445 وطرق التسجيل في الضمان الجديد - جريدة لحظات نيوز

استعلام عن الضمان المطور عن طريق النفاذ الوطني في السعودية .. خطوات التسجيل في الضمان | خدمات السعودية

الآن.. استعلام عن الضمان المطور عن طريق النفاذ الوطني 1445 برقم الضمان الاجتماعي بالمملكة العربية السعودية - بلد نيوز